Coretrust prioritizes sustainability, health and wellness for a low-carbon solution and a safe return to the office.

Coretrust Capital Partners has signed the United Nations-supported Principles for Responsible Investing (UN PRI), strengthening its commitment to incorporating environmental, social and corporate governance (ESG) considerations into its development and operational decision-making.

Coretrust Capital Partners has achieved carbon neutrality across its 2.5 million square foot office building portfolio, further reinforcing its leadership in ESG.

Coretrust sets the standard in health and wellness for the safe return to the office

Coretrust establishes a bi-polar ionization technology for the purification of elevator air in its office buildings.

Coretrust establishes a bi-polar ionization technology for the purification of elevator air in its office buildings.

Co-founder Thomas Ricci is branching out into real estate asset management for investors.

If you're sick of working remotely, you may be in luck thanks to new technologies implemented at offices.

Coretrust Capital Partners has unveiled ADIBOT UV-C Disinfecting Robots that disinfect air and surfaces against COVID-19 and other harmful airborne pathogens as the centerpiece of multiple anti-COVID technologies at its office properties..

From the moment an employee comes back to work at the old "L.A. Law" building in downtown Los Angeles, almost everything will be touch-free.

Instead of using the pandemic as a quiet period, downtown-based real estate investment firm Coretrust Capital Partners has used the time to make improvements that would normally take much longer on some of its office properties.

With Los Angeles County administering 9 million COVID-19 vaccinations, many Angelenos are slowly making the transition back to work. Coretrust Capital Partners, which owns the 444 S. Flower Street office building, is helping tenants return safely by implementing anti-COVID-19 technology in its office buildings.

Global engineering firm Syska Hennessy plans to move its West Coast regional headquarters in July to an office tower in downtown Los Angeles.

Los Angeles, CA — The international engineering firm Syska Hennessy will move its West Coast headquarters and Los Angeles office to FourFortyFour South Flower Street in downtown Los Angeles, with a relocation slated for July 2021.

UL, the global safety science leader, today announced that FourFortyFour South Flower in downtown Los Angeles has become the first building globally to earn the UL Verified Healthy Buildings Mark for Indoor Air and Water.

The Pasarroyo, formerly known as Corporate Center Pasadena, occupies a 6-acre city block and is comprised of four buildings containing more than 650,000 square feet of commercial space.

When you finally head back to the office, it won’t be like you remember it. Physical distancing, from the garage to the elevator to the break room, promises to help make the pending mass return to the workplace both reassuring and maddening as people learn to work together again while…

Coretrust Capital Partners is partnering with Connectivity Wireless Solutions to transform its downtown Los Angeles tower, FourFortyFour South Flower, into a smart building with state-of-the-art 5G technology that gives tenants and guests the fastest possible internet speeds and complete cellular coverage.

LOS ANGELES, CA — Coretrust Capital Partners is partnering with Connectivity Wireless Solutions, a provider of wireless solutions to enterprise and wireless service provider customers throughout the U.S., to transform its downtown Los Angeles tower, FourFortyFour South Flower, into a smart building with state-of-the-art 5G technology that gives tenants and guests the fastest possible internet…

Coretrust Capital Partners creates a one-of-a-kind showcase of the future of office space

An iconic high-rise in downtown L.A.—whose owners removed the glass from some windows—is just the latest and most literal example of a trend toward free-flowing workplaces.

What will the high-rise office space of the future offer? Maybe fresh air from a hole in the curtain wall, the piped-in sound of trickling water and the smell of the seashore? These are what you’ll find in downtown LA’s “Workplace Innovation Lab.”

https://vimeo.com/314340984/a01f61a612

No Longer Called Citigroup Center, Building is Open for New Leasing, Naming Rights June 13th, 2018: Jacquelyn Ryan, Los Angeles Market Reporter | CoStar Group Two hundred Los Angeles commercial real estate brokers recently received deliveries of specialty Lego sets that can be built into replicas of a downtown building…

Coretrust Capital Partners is getting creative when it comes to marketing space at its western regional headquarters downtown. The commercial real estate firm is asking brokers and other people to reconstruct Citigroup Center at 444 S. Flower St. in downtown Los Angeles. Read article below:

Downtown real estate investment firm Coretrust Capital Partners has purchased Pasadena’s largest office campus, the six-acre PASARROYO, according to the company. Coretrust bought the four-building property at 201, 225, 251 and 283 S. Lake Ave., which spans a full city block and includes more than 640,000 square feet of commercial…

Download Press Release PHILADELPHIA, PA – May 8, 2018 – Coretrust Capital Partners, LLC, as U.S. Asset Manager for Korea Investment Management Co., Ltd. (KIM), has advised KIM in the acquisition of 5 Crescent Drive, a 208,000-square-foot office building in the Navy Yard submarket of Philadelphia. The seller was Liberty…

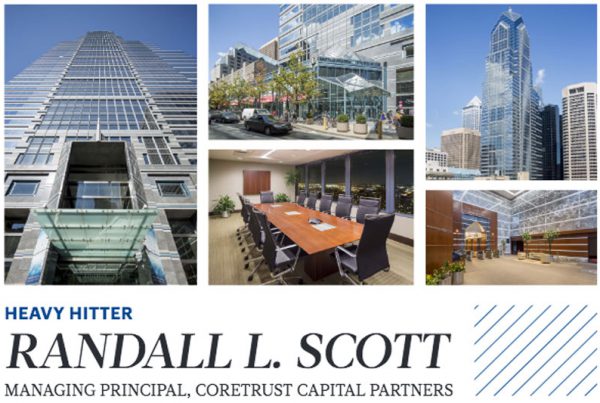

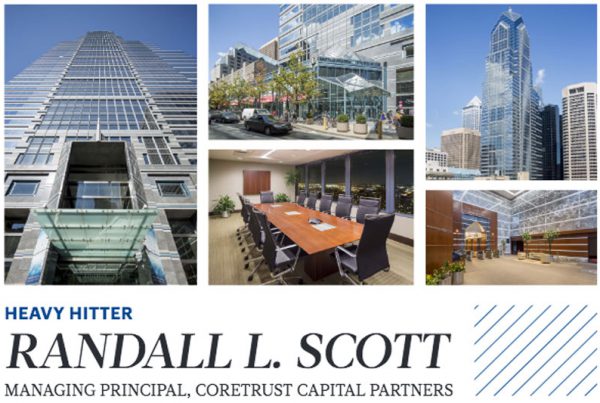

Managing Principal Randall L. Scott of Coretrust Capital Partners sits down with Philadelphia Business Journal to discuss the $220M purchase of Two Liberty Place Office Condominiums in Center City Philadelphia. He shares some of his thoughts on real estate deals, business advice, and reflects on past decisions.

It won’t be long until workers in a prominent downtown L.A. high-rise will step outside hundreds of feet in the air to lounge on patio furniture among planters brimming with succulents, and perhaps even warm themselves next to a fire pit. The new owners of the silver-skinned Citigroup Center in the…

REAL ESTATE: Trio looks to fill Citibank Center offices. Downtown veterans look to build on legacy by reviving office space at Citibank Center.

Philadelphia Business Journal features Two Liberty Place in their October 2016 edition. Write up includes some of the possible challenges that Coretrust Capital Partners face in regards to their planned series of renovations for the recently purchased office portion of Two Liberty Place. Multiple ownership structures control various aspects of the…

Jacquelyn Ryan, Los Angeles | Business Wire Los Angeles, CA – November 17, 2016 – Coretrust Capital Partners, LLC, through its investment fund, Coretrust Value Fund I, purchased the controlling interests in multiple Two Liberty Place ownership entities. Two Liberty Place, totaling 1.2 million square feet, is an iconic part…

Download Press Release Los Angeles, CA – March 23, 2016 – Coretrust Capital Partners, LLC, as U.S. Asset Manager for Korea Investment Management (KIM), has advised KIM in the acquisition of Cira Square, an 863,000 square foot office building at 2970 Market Street in the University City submarket of downtown…

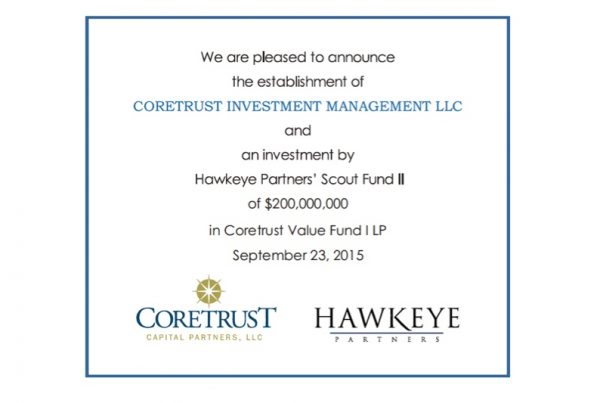

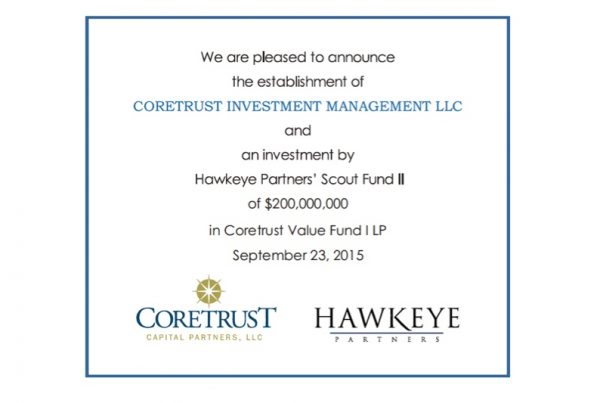

Download Press Release Los Angeles, CA – October 14, 2015 – Coretrust Capital Partners, LLC, a private real estate operating company, was selected for inclusion in the Scout Program and has closed its first fund with an initial $200 million equity commitment from Scout Fund II, a fund managed by…